Card on file payments is a new norm in today’s world. The typical US customer has 2-3 online subscriptions. Since the rise of COVID 19, online shopping has raised over 32%. We are looking into what this data means for financial institutions and where consumers are spending their money online.

Stored Cards on file provide a quick way for consumers to shop online. Strivve powers financial institutions with an easy and secure solution for placing their cardholder’s cards as the default payment method where they are shopping online, pushing the FI to Top of Wallet®.

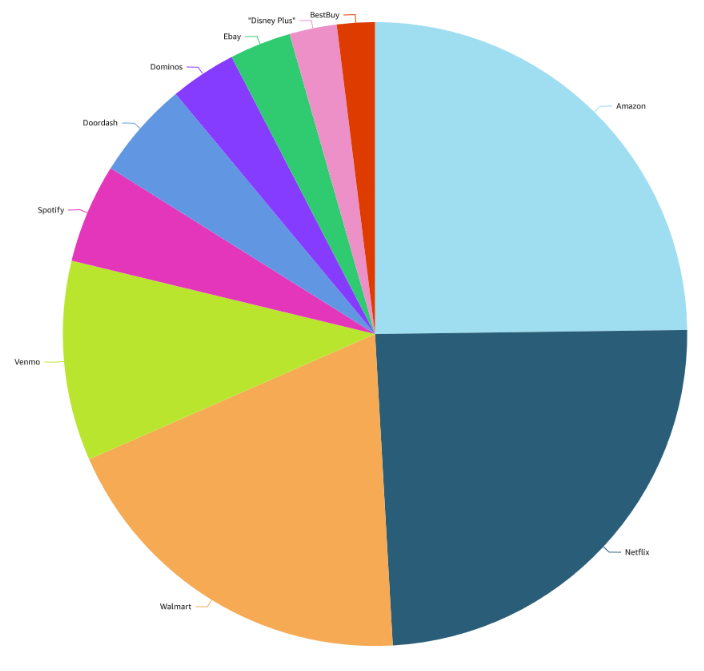

Where are cardholders storing their cards on file and how much are they spending?

In 2021, our number one card on file placement was to Amazon.

A typical prime member will spend 1,400 U.S. dollars at Amazon every year, and 600 U.S. dollars spending of non-Prime members. This means a large opportunity to grow in transaction volume, interest income, and interchange revenue for every card placed on file- all while saving the cardholder the hassle of updating payment information on sites individually.

The second most popular site that Strivve placed cards on file to was Netflix.

Netflix and other subscriptions are a perfect location for a financial institution to have their card on file because of the guaranteed monthly income. Subscriptions to Netflix range from $8.99 to $17.99 a month.

Walmart

Walmart was the 3rd most popular site to place cards on file in 2021. Last year, Walmart saw that members were spending an average $1,100 per year on Walmart’s website

Spotify

Another subscription that guarantees our customers $10.00 to $16.00 in transaction volume per month per credit or debit card stored as default payment method.

Doordash

The average Doordash customer spends $37.28 per order and is required to store a card on file. Strivve has made it easy for our FI customers to ensure their card is the card being charged for each order.

Reap the financial benefits of being Top of Wallet online with Strivve.

About Strivve, Inc.

Headquartered in Seattle, Strivve creates cardholder experiences that drive cards to Top of Wallet®. The company’s payment card solutions protect and increase card transaction volume for issuers. Strivve’s proprietary and patented autonomous browsing technology, CardSavr, helps cardholders update any card on any site. You can learn more about Strivve at strivve.com or follow the company on the Strivve Blog, LinkedIn and Twitter.

Contact Information

Lauren Patrick

Leave A Comment