We unveiled our new CardSavr® API at the end of February and we’re excited about its progress and the feedback we’re receiving!

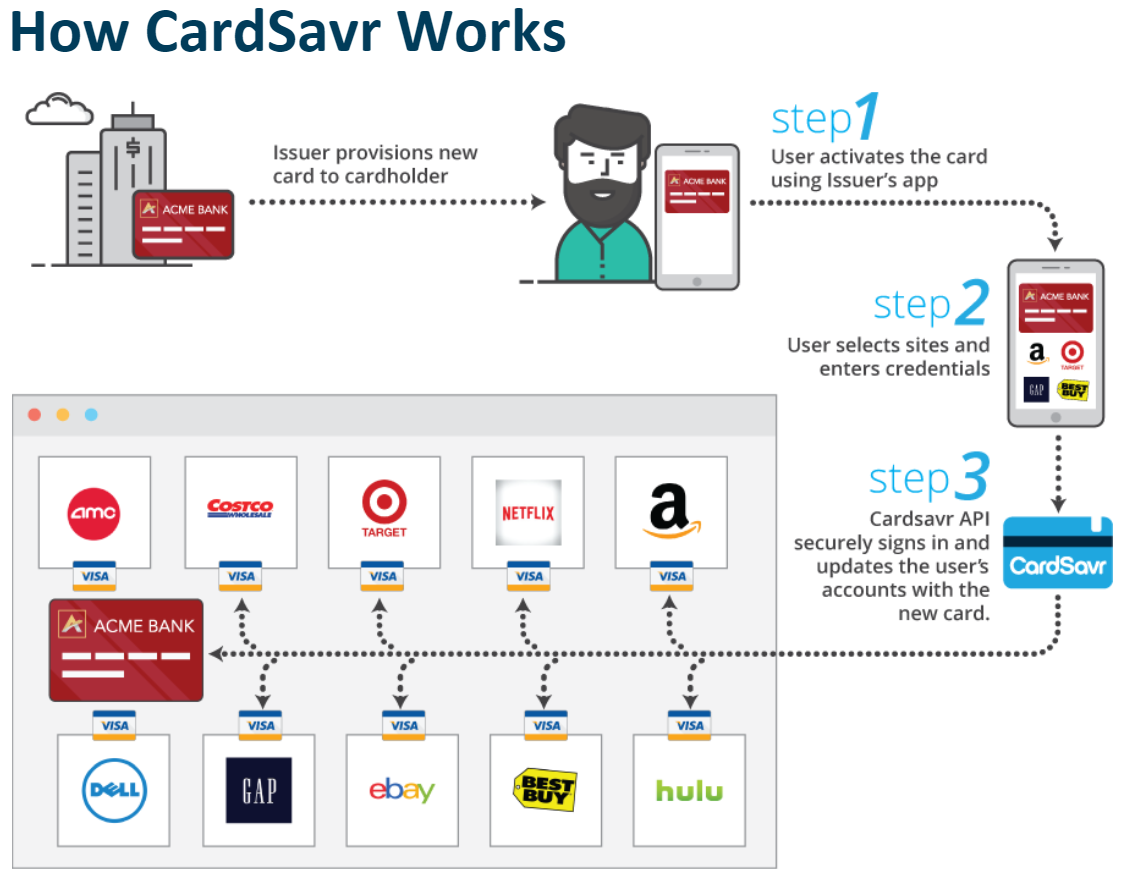

Following positive response from early adopters, strategic partner feedback, we recognized an opportunity to leverage Strivve‘s core technology into the development of CardSavr. Our first-of-its-kind API empowers all card issuers with the ability to ensure new and reissued cards are placed into use on thousands of e-commerce sites immediately upon activation.

CardSavr’s design brings many unparalleled benefits to card issuers:

- Immediate validation of customer card use

- Recaptured and increased revenue during the reissuing process

- Increased new card activations

- Provide cardholders with an easier way to update cards at merchant sites

“This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue.”

“Until CardSavr, banks and merchants were held hostage by archaic credit card networks’ issuing and replacement processes and the inability alone to digitally help their cardholders manage online payments,” said Chris Hopen, CEO of Strivve, Inc. “This is the first time an API provides all card brands with direct control over a large source of potential and/or lost revenue. Our platform increases both their bottom line around credit card circulation issues and enhances cardholders’ online purchasing experiences. All parties of the e-commerce ecosystem benefit.”

CardSavr supports thousands of online merchants and by using anonymized crowdsourcing techniques paired with our machine learning engine, the number of supported merchant sites grows every day. The API assists e-commerce sites without any technical integration necessary by the merchants. This results in a far greater reach for card updates than conventional methods currently in use by card networks.

CardSavr enables card issuers to embed our card-updating technology into their existing web and mobile banking applications while maintaining 100% control over their branded user experience.

“This update [from Strivve] is a major win for all, ranging from retailers and card issuers to consumers, since it allows a more seamless process in updating re-issued cards … that are used for recurring billing,” says Michael Moeser, director of payments at Javelin Strategy & Research, to Digital Transactions. “It alleviates the burdens of forgotten cards on file at the gym, Netflix, etc. and gives more control over how those cards are used.”

As a standard REST API, CardSavr enables issuers to embed our card-updating technology into their existing web and mobile banking application infrastructures. This is accomplished while the issuer maintains 100% control over their brand’s user experience. CardSavr utilizes advanced cryptography practices that exceed PCI requirements and banking standards for protecting credit card data for increased cardholder security.

CardSavr is available to issuers today. Learn more about our API at strivve.com/cardsavr!

Leave A Comment